Uganda’s economy is on a path of steady growth with inflation remaining well-contained, although amid softening business confidence and a tightening of concessional financing channels. The macroeconomic outlook is cautiously optimistic, with consumer demand and overall economic activity projected to increase in the upcoming year. Expectations for strong medium-term growth of 6-7 percent, sustained by increased private sector activity, heightened investment in the extractive industries, and an increase in exports.

However, the economic forecast is subject to various risks that could dampen growth. The potential increase in domestic borrowing due to diminished concessional inflows, following the suspension of World Bank funding, may lead to private-sector credit constraints and higher borrowing costs, pushing the government closer to its fiscal limits. Global financial instability continues to pose a threat, with the possibility of capital outflows and a strengthening U.S. dollar placing pressure on the substantial dollar-denominated debt. Volatility in commodity prices remains a concern for export revenue, while issues like fiscal indiscipline and leakages could compromise public financial management. Moreover, geo-political tensions and climate-related events pose downside risks to the growth outlook.

Going forward, Uganda’s strategic focus will be on accelerating Agro-industrialization, harnessing science, technology, and innovation for increased productivity, and promoting exports, with focused efforts on developing the oil, gas, and mineral sectors. There is also a commitment to improving tourism infrastructure. Fiscal policy is set to concentrate on improving tax administration, ensuring efficient public investment, and seeking sustainable financing methods, reflecting the government’s dedication to maintaining fiscal discipline while supporting economic growth.

Real Sector

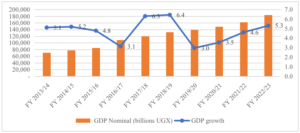

There has been a robust expansion of the economy, with the GDP growth rate rising from 4.6 percent in FY 2021/22 to 5.4 percent in FY 2022/23, reflecting a significant upswing in economic activity. The economy’s nominal size experienced a marked increase from UGX 162,883 billion in FY 2021/22 to UGX 184,228 billion in FY 2022/23 largely due to improved performance of food crops, livestock, fishing, and services especially ICT and accommodation and food services.

Nominal GDP and Real GDP growth rates

Source: UBOS

The economic structure reflects a clear dominance of the services sector, which has seen its contribution to the GDP grow significantly from 41.6 percent in the previous financial year to 42.6 percent in FY 2022/23. Following closely behind are the industry and agriculture sectors, contributing 26.7 percent and 24.0 percent, respectively, to the GDP. This growth is driven by the Manufacturing, Food Crops, and Trade sectors in particular, accounting for approximately 15.7, 11.8, and 9.2 percent contribution to GDP as of FY 2022/23.

Sectoral contribution to GDP

| SECTOR | 2019/20 | 2020/21 | 2021/22 | 2022/23 |

| Agriculture | 23.9 | 23.9 | 24 | 24 |

| Food crops | 11.6 | 11.5 | 11.4 | 11.8 |

| Livestock | 3.8 | 3.9 | 4 | 4 |

| Forestry | 4.1 | 4.1 | 3.9 | 3.7 |

| Cash crops | 2 | 2.1 | 2.7 | 2.5 |

| Industry | 26.5 | 27.1 | 26.7 | 26.1 |

| Manufacturing | 15.8 | 16.4 | 16.4 | 15.7 |

| Construction | 5.5 | 5.2 | 5.5 | 5.3 |

| Water | 2.2 | 2.2 | 2.1 | 2.1 |

| Mining & quarrying | 1.6 | 1.9 | 1.4 | 1.9 |

| Services | 42.8 | 41.8 | 41.6 | 42.6 |

| Trade and Repairs | 8.4 | 7.9 | 8.4 | 9.2 |

| Real Estate Activities | 6.4 | 6.3 | 6.3 | 6.1 |

| Education | 4.1 | 3.8 | 3.6 | 3.7 |

| Transportation and Storage | 3.4 | 3.2 | 3.2 | 3.6 |

Source: UBOS

Going to forward, the economy is expected to continue on a recovery path, driven by anticipated growth in the services, industry, and agriculture sectors, supported by a resurgence in aggregate demand and the rollout of Parish Development Model funds. This is further complemented by increasing investments in the Oil and gas sector and an expansion in regional trade.