International Trade and Finance

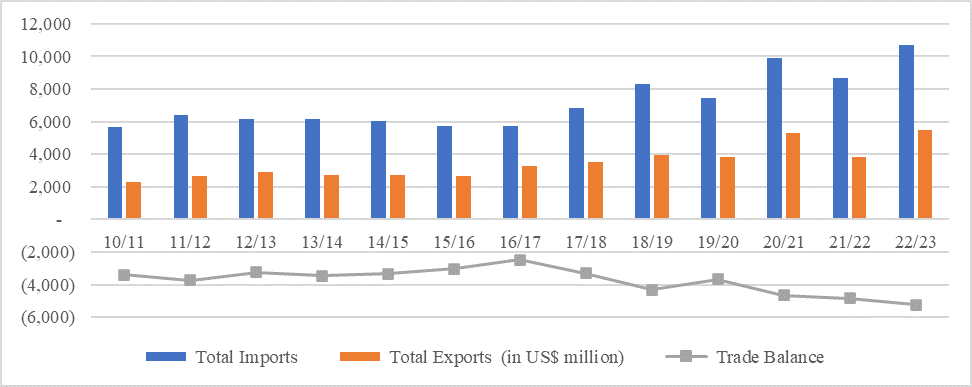

In FY 22/23, Uganda reported a trade deficit of USD 5,248.20 million, despite gains in merchandise exports. Total exports for the year grew by 42.5 percent, reaching USD 5,466.99 million compared to USD 3,837.66 million in FY 21/22 (Figure 1). Coffee exports, traditionally significant for Uganda, declined by 1.9 percent to USD 845.41 million. In contrast, non-coffee formal exports rose by 65.9 percent to USD 4,074.38 million. Gold exports were notably introduced at USD 1,135.33 million from nil in the previous financial year, and maize exports increased by 259.3 percent to USD 182.18 million.

In the same review period, external factors such as supply chain disruptions and the Russia-Ukraine conflict influenced commodity prices globally. This, in turn, contributed to a rise in Uganda’s import costs, leading to imported inflation. The country’s import expenditure increased by 23.4 percent to USD 10,715.19 million, up from USD 8,679.32 million the previous year. The increase was most prominent in ‘Mineral Products (excluding Petroleum products)’, which saw a 349.7 percent rise, followed by ‘Petroleum Products’ at 32.4 percent and ‘Machinery, Equipment, Vehicles & Accessories at 20.5 percent.

Annual Composition of Trade Balance USD Million

In the 12 months leading to April 2023, Uganda’s external position showed stability against the supply chain disruption and the spillover effects of the Russia-Ukraine conflict. The current account deficit was stable at USD 3,827.0 million. This stability can be attributed to strong remittance inflows that supported the secondary income account.

The secondary income account balance increased by 18.1 percent to USD2,029.8 million, with remittances recorded at USD 1,393.4 million, reflecting global economic growth and heighten labor outflows. Additionally, the primary income account deficit decreased by 3.8 percent to USD 759.6 million due to higher income from reserve assets.